Secure your financial future with smart offshore trusts asset protection planning.

Secure your financial future with smart offshore trusts asset protection planning.

Blog Article

Vital Insights on Offshore Trust Possession Security Solutions for Financiers

When it concerns securing your wealth, offshore depends on can be a vital solution. They use legal frameworks that secure your properties from financial institutions and lawful claims while enhancing your privacy. Steering with the complexities of these counts on calls for mindful consideration. Selecting the right jurisdiction and understanding the advantages and dangers involved is crucial. What particular aspects should you think about to ensure your overseas trust serves your passions effectively?

Comprehending Offshore Trusts: A Comprehensive Introduction

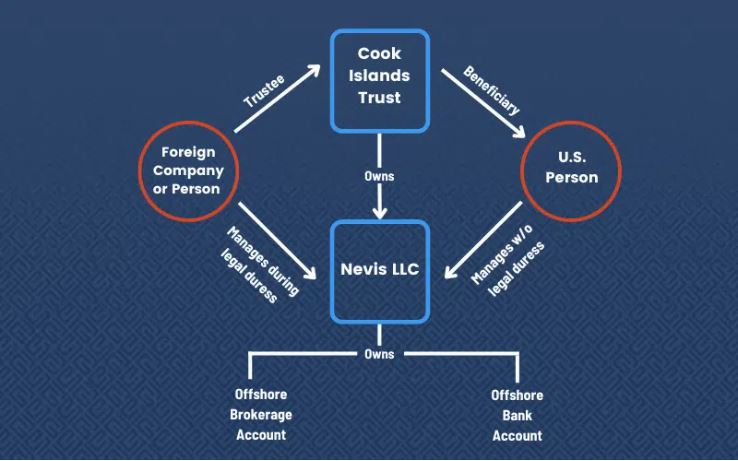

When taking into consideration property defense, understanding offshore trust funds is vital. Offshore trust funds are legal entities developed in jurisdictions outside your home country, created to secure your assets from prospective risks. You can develop these trusts for various reasons, such as privacy, wide range administration, and, most notably, security versus financial institutions and lawful cases.

Commonly, you designate a trustee to take care of the depend on, guaranteeing that your assets are managed according to your wishes. This separation in between you and the properties aids shield them from lawful susceptabilities and potential financial institutions.

While establishing an overseas count on might involve preliminary expenses and intricacy, it can supply assurance knowing your wide range is safe. You'll wish to thoroughly look into various jurisdictions, as each has its own policies and tax effects. Comprehending these nuances will empower you to make educated choices concerning your possession protection strategy.

Secret Benefits of Offshore Depend On Asset Protection

When you take into consideration offshore depend on asset security, you disclose considerable advantages like boosted personal privacy measures and tax optimization techniques. These advantages not just guard your wealth but additionally provide you with higher control over your monetary future. offshore trusts asset protection. Recognizing these key benefits can assist you make notified decisions about your assets

Enhanced Personal Privacy Steps

Although you could currently be aware of the monetary advantages of offshore counts on, one of their most compelling attributes is the enhanced personal privacy they provide. By positioning your assets in an offshore depend on, you secure your riches from public examination and possible lenders. This level of discretion is especially valuable in today's world, where personal privacy is significantly in jeopardy.

You can choose jurisdictions with rigorous personal privacy laws, guaranteeing your monetary affairs remain discreet. Offshore trust funds can also help you separate personal and company properties, additionally securing your identification and rate of interests. This personal privacy not just safeguards your assets yet also supplies satisfaction, allowing you to concentrate on your investments without the anxiousness of undesirable focus or interference.

Tax Obligation Optimization Techniques

Legal Frameworks Governing Offshore Trust Funds

Comprehending the lawful structures governing overseas counts on is crucial for anyone considering this property security technique. offshore trusts asset protection. These frameworks vary substantially throughout territories, so it is necessary to familiarize on your own with the guidelines and requirements in your selected place. A lot of overseas depends on operate under the laws of particular countries, usually created to use positive conditions for asset protection, privacy, and tax effectiveness

You'll require to review factors like count on registration, trustee obligations, and recipient legal rights. Compliance with global laws, such as anti-money laundering policies, is also important to stay clear of legal issues. Furthermore, some territories have specific policies relating to the credibility and enforceability of depends on, which can affect your total technique.

Choosing the Right Territory for Your Offshore Trust

Just how do you pick the ideal jurisdiction for your overseas depend on? Take into consideration the legal structure. Seek countries with durable possession security regulations that align with your objectives. You'll also wish to review the political and financial security of the jurisdiction; a secure atmosphere minimizes risks to your possessions.

Following, analyze tax ramifications. Some territories supply tax obligation look at this web-site advantages, while others may enforce high tax obligations on trust earnings. Choose an area that optimizes your tax effectiveness.

A well-regarded location can enhance the reputation of your depend on and offer peace of mind. Having trusted lawful and monetary consultants can make a substantial difference in handling your count on properly.

Typical Kinds Of Offshore Trusts and Their Uses

When considering overseas counts on, you'll come across various kinds that offer different functions. Revocable and irrevocable trusts each offer unique advantages regarding versatility and property defense. Additionally, possession protection counts on and charitable rest depends on can assist you protect your wide range while supporting reasons you care about.

Revocable vs. Irrevocable Counts On

While both revocable and irreversible trusts offer essential functions in offshore possession defense, they work rather differently based on your goals. A revocable trust fund enables you to preserve control over the properties throughout your lifetime, letting you make adjustments or revoke it totally. This adaptability is fantastic if you want access to your possessions, yet it doesn't supply strong defense from lenders given that you're still considered the proprietor.

In comparison, an unalterable count on transfers possession of the properties far from you, supplying a stronger guard versus creditors and lawful insurance claims. As soon as developed, you can not easily change or withdraw it, but this durability can boost your possession protection strategy. Picking the right type depends on your particular demands and long-term purposes.

Property Security Trust Funds

Possession defense counts on are important devices for guarding your wide range from possible lenders and lawful insurance claims. These counts on can be found in different forms, each created to meet specific demands. One common kind is the Domestic Asset Protection Depend On (DAPT), which permits you to maintain some control while shielding assets from lenders. Another choice is the Offshore Possession Protection Count on, normally set up in territories with solid privacy laws, providing higher protection against suits and creditors. By positioning your possessions in these trusts, you can effectively distance them from your personal responsibilities. It's essential to select the best kind of depend on based on your financial circumstance and objectives, guaranteeing you maximize the advantages while lessening dangers.

Philanthropic Remainder Depends On

Charitable Rest Depends On (CRTs) provide a distinct means to accomplish both philanthropic goals and financial advantages. By establishing a CRT, you can contribute possessions to a charity while retaining revenue from those possessions for a specific period. This approach not just supports a charitable reason however also supplies you with a possible revenue tax reduction and helps decrease your taxable estate.

You can pick to get income for a set term or for your life time, after which the remaining properties go to the assigned charity. This dual benefit permits you to take pleasure in financial versatility while leaving a long-term effect. If you're aiming to balance charitable purposes with personal monetary demands, a CRT may be an company website excellent service for you.

Prospective Challenges and Risks of Offshore Depends On

Although overseas depends on can provide significant advantages, they aren't without their potential mistakes and dangers. You could encounter higher costs associated with developing and preserving these trust funds, which can consume into your More Bonuses returns.

Finally, not all overseas territories are created equivalent; some might lack durable securities, leaving your properties prone to political or economic instability.

Actions to Establish Up and Manage Your Offshore Count On

Next off, pick a dependable trustee or trust business experienced in handling overseas trust funds. It's important to money the trust fund properly, moving possessions while adhering to lawful needs in both your home nation and the overseas territory.

Once established, routinely testimonial and update the trust fund to reflect any type of adjustments in your financial scenario or family members dynamics. By adhering to these actions, you can secure your possessions and attain your economic objectives effectively.

Often Asked Questions

Just How Much Does Setting up an Offshore Count On Usually Cost?

Establishing an offshore trust fund usually costs in between $3,000 and $10,000. Aspects like complexity, territory, and the service provider you choose can affect the complete expense, so it is essential to investigate your choices extensively.

Can I Be the Trustee of My Own Offshore Count On?

Yes, you can be the trustee of your own offshore trust, but it's commonly not advised. Having an independent trustee can supply additional possession protection and integrity, which may be advantageous for your financial approach.

What Occurs to My Offshore Depend On if I Move Countries?

If you move countries, your offshore depend on's lawful condition may alter. You'll require to think about the new jurisdiction's legislations, which may affect tax obligation implications, reporting demands, and asset defense. Consulting a legal specialist is important.

Are Offshore Trusts Subject to United State Taxes?

Yes, overseas depends on can be subject to U.S. taxes. If you're a united state taxpayer or the depend on has U.S. properties, you'll require to report and potentially pay tax obligations on the income generated.

Exactly How Can I Gain Access To Funds Held in an Offshore Depend On?

To access funds in your offshore trust, you'll normally need to adhere to the depend on's distribution standards. Consult your trustee for certain treatments, and validate you understand any kind of tax effects before making withdrawals.

Verdict

Finally, offshore trust funds can be powerful tools for safeguarding your assets and protecting your wealth. By recognizing the advantages, lawful frameworks, and types of trusts offered, you can make educated choices regarding your monetary future. Picking the ideal jurisdiction is crucial, so take your time to research study and seek advice from with experts. While there are threats included, the assurance and protection that feature a well-structured offshore depend on often outweigh the prospective disadvantages.

Report this page